Before you can manage your risk, you need to understand it. You need to look at all your portfolios; And with this I don't mean only your equity portfolio, but all your assets base – home, cash ownership, funds, a lot. If for example you have a house of £ 1 million, and only £ 10,000 equity portfolio, then do you really think you have to hold Builybuilders' shares?

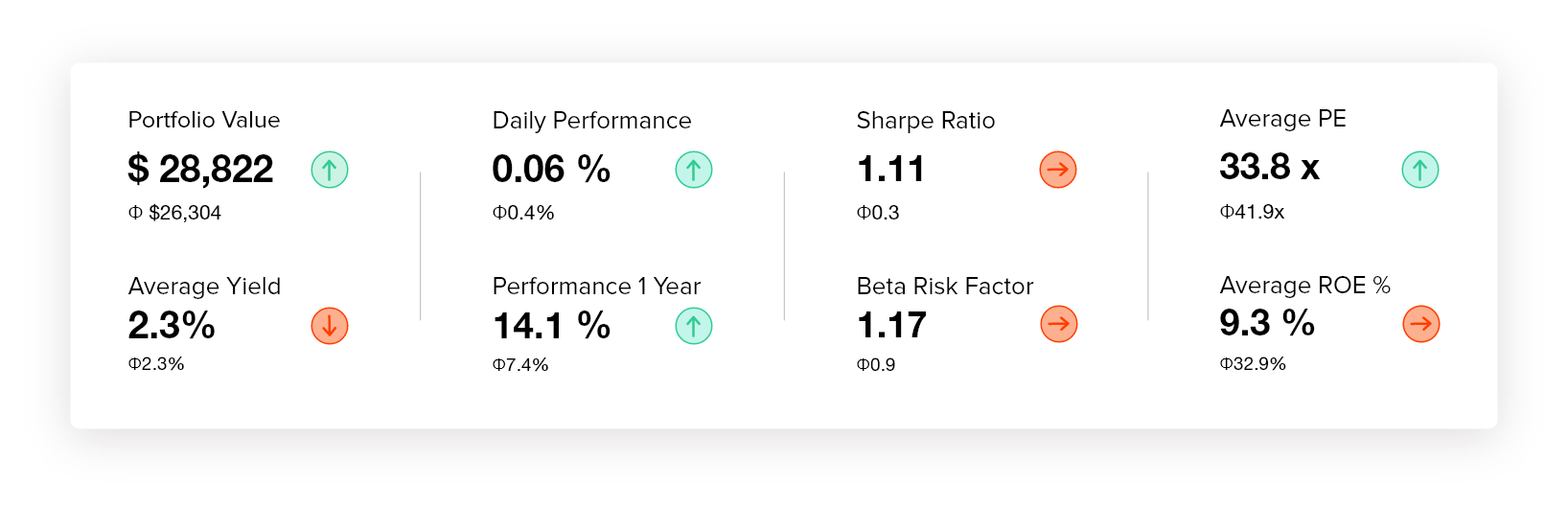

If you have a large amount sitting in cash, then you are able to risk more with your equity – if one of your high-flying technology shares goes down to earth with a lump, it won't kill you. Get nuances for the overall proportion of different assets in your asset base, and relative risk levels. You can Stay on Top of Your Portfolio with Ziggma Portfolio Analytics.

The next stage must see your equity asset. For many investors, I would say see the ownership of your funds and equity, and look at the troubleshooting portfolio of funds for your funds, and especially ten ownership.

Look at the proportion of the equity that you have in each sector against benchmarks. Consider how many of your portfolios in each sector compared to benchmarks, and how many in every geographical area compared to benchmarks. Now it's not like some fund managers, you are not obliged to compare – indeed, to defeat the index, obviously you shouldn't! But you have to see your difference from benchmark and ask if it's a good idea.